Management Liability Insurance

Management Liability insurance provides peace of mind for your company and the directors & officers of the business.

Management Liability Insurance helps safeguard a business and its directors and officers from the cost of defending actions related to alleged mismanagement, breach of duty, regulatory investigations, or employment-related disputes.

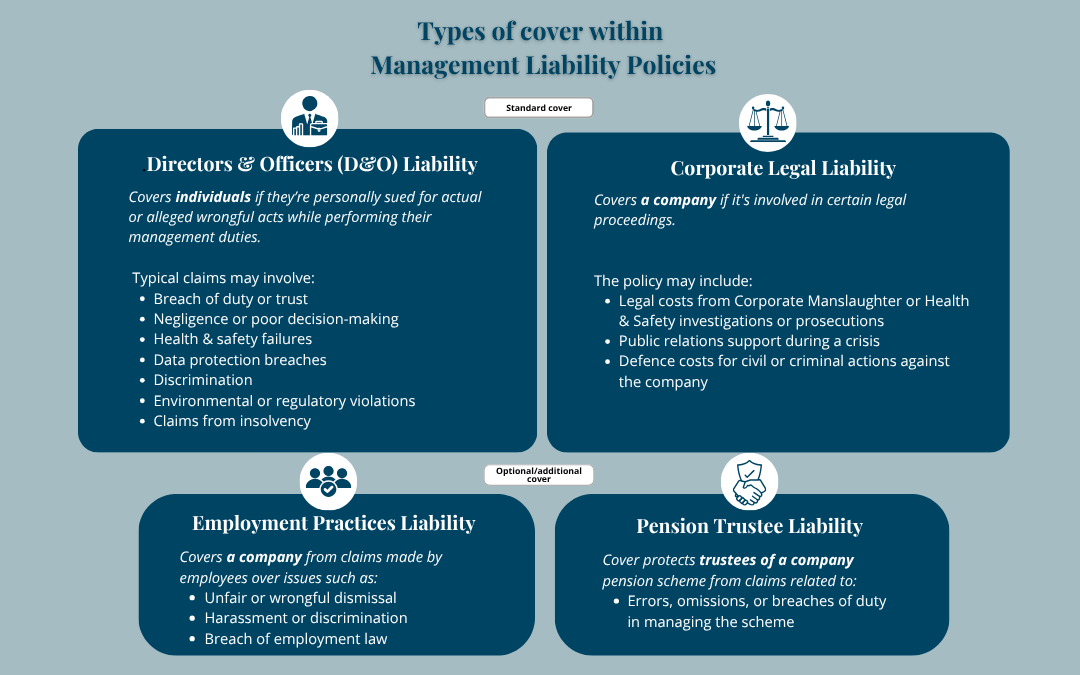

This type of insurance includes cover for:

- Directors & Officers (D&O) Liability – protects individuals against personal claims for decisions made in their role

- Corporate Legal Liability – covers the business itself against legal action such as regulatory breaches or investigations.

Additional covers - Employment Practices Liability – protects the company against claims from employees, including unfair dismissal, discrimination, or harassment.

- Pension Trustee Liability – protects trustees of company pension schemes against errors, omissions or breaches of duty in managing the scheme