One claim could cost you everything!

Running a business isn’t just about making the right decisions, it’s also about being prepared when things go wrong. In today’s fast-moving legal and regulatory environment, directors and senior managers can be held personally responsible for the decisions they make. For small and medium-sized enterprises (SMEs), a single claim could have devastating financial consequences.

Since the abolition of Employment Tribunal fees in July 2017, employee claims have risen sharply. According to a 2024 article published by Lexology, the Ministry of Justice recorded over 42,000 single person tribunal claims in the UK during 2024–2025, an increase of 23% from the year before. Multiple person claims also rose by 23%, indicating a sustained upward trend in employment-related disputes.

At the same time, regulatory scrutiny continues to grow. Directors face potential investigations under health and safety laws, data protection rules, and corporate governance obligations. In many cases, claims are made not just against the business, but against individuals in leadership positions, leaving their personal finances exposed.

This is where Management Liability Insurance steps in…

What Is Management Liability Insurance?

Management Liability Insurance is a combined policy designed to protect your business and its decision-makers (typically directors, officers, and senior managers) against legal claims brought due to the way your business is managed.

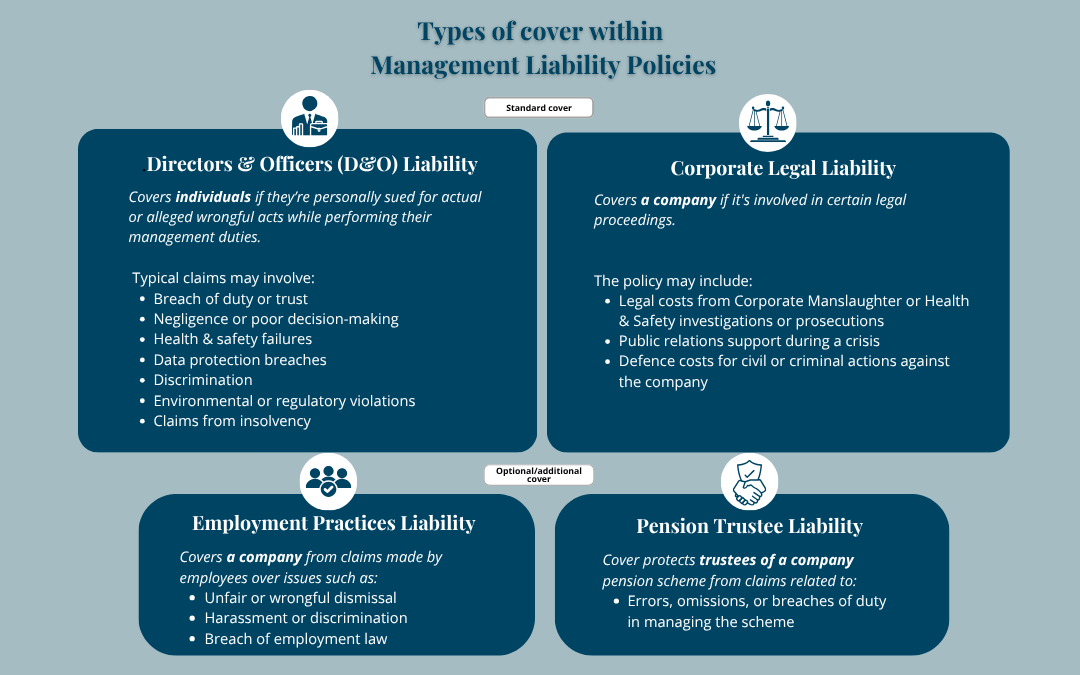

It brings together several areas of cover:

- Directors & Officers (D&O) Liability

- Corporate Legal Liability

- Optional Extensions:

- Employment Practices Liability

- Pension Trustee Liability

Why your company needs Management Liability Cover

- Protecting personal assets

If you’re a company director, your liability is unlimited. That means you could be held personally responsible for wrongful acts or management decisions, even if unintentional. Without D&O cover, your home, savings, and personal assets could be at risk. - Claims don’t just happen to big companies

Small businesses are just as vulnerable to legal action as large corporations. Whether it’s a former employee alleging discrimination or a health and safety issue, the costs of defending a claim can be just as damaging to an SME. - Claims can come from anywhere

It’s not just employees or regulators. Claims may come from shareholders, clients, suppliers, customers, or even competitors. Disgruntled parties often look to directors and officers when something goes wrong. - Insolvency risks

If a business enters financial distress, directors can be accused of wrongful trading or failing to act in the best interest of creditors. Management Liability Insurance can provide defence cover if claims arise from insolvency-related issues. - Professional Indemnity

While Professional Indemnity (PI) insurance protects the company from negligence in professional services, it doesn’t cover individual directors or officers for wrongful acts. That’s where Directors & Officers and Corporate Legal Liability come in. - Employment Tribunal claims are on the rise

As mentioned earlier, Employment Tribunal claims have surged since 2017. Employment Practices Liability insurance provides cover for legal defence costs and settlements arising from allegations of unfair dismissal, harassment, or breach of employment law.

Management Liability Insurance is not a luxury, it’s a vital layer of protection. Legal claims are rising. Regulatory expectations are higher than ever. And for directors, officers, and business owners, the personal consequences can be severe.

Whether you run a start-up, a growing enterprise, or a well-established business, protecting your people and your business from management-related risks is just smart planning.

Want to know more?

Get in touch to discuss how a tailored Management Liability policy can safeguard your business.