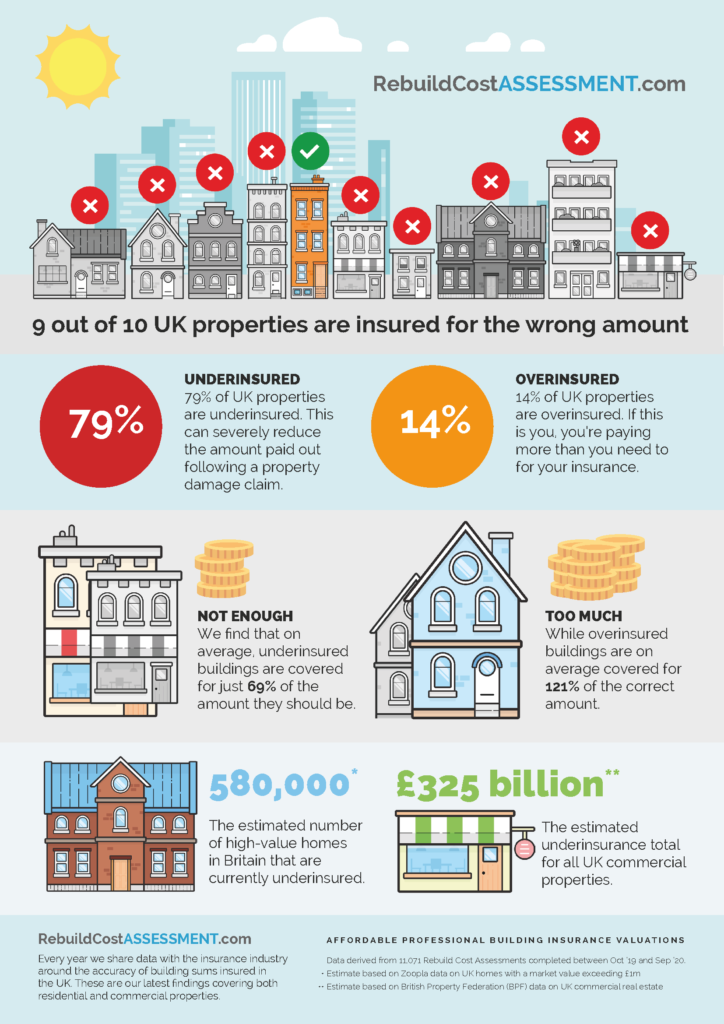

It’s a startling statistic: 79% of properties in the UK are underinsured. But what are the potential consequences of underinsurance?

What is underinsurance?

Underinsurance occurs when a property is insured for less than the total cost to rebuild it.

If your property is found to be underinsured following a damage claim, insurers could reduce the value of the claims settlement proportionately in line with the amount of underinsurance. Sometimes, they may even consider the underinsurance to be materially misleading and refuse to pay any of the claim.

Common causes of underinsurance

If you mistakenly base your building sum insured on the market value of your property, or a mortgage valuation. For insurance purposes, your building sum insured should always be based on the rebuilding cost.

Some other common issues are:

- Where a property has never been professionally valued for insurance purposes, or the valuation has not been reviewed in the past three years.

- You have altered or extended the property, but not subsequently reviewed your buildings sum insured.

- You are not VAT registered but your building sum insured excludes VAT.

The rebuilding value of your property should also take into consideration costs such as professional fees, site clearance and the replacement costs of periphery items such as gates, fences or car parking areas and any other items as included within the definition of buildings under your insurance policy.

If the cost to rebuild your property is £1,000,000 but your building sum insured is only £500,000, then you would effectively be underinsured by £500k or 50%. In this example your insurer would only cover 50% of any loss, no matter what the size of the claim.

How Adler Fairways can help

Adler Fairways Insurance Brokers have RICS accredited partners who offer rebuild cost assessment options to suit your needs.

You can choose from two forms of assessment:

Site Survey

This involves a visit to the premises; it is the most accurate means of valuing the property for insurance purposes. This method should particularly be considered where there are multiple buildings, where the construction is nonstandard or where properties have listed status.

Desktop assessment

A desktop assessment utilises satellite imagery and multiple data points to produce a comprehensive report without anyone visiting the premises. Whilst this is likely to be less accurate than the site survey it offers a cost-effective option for less complex buildings.

Whatever assessment method you choose, if you own or are responsible for insuring your property it is vital that it is insured for the correct amount. This will ensure you are not underinsured or even over insured and will minimise the risk to your business in the event of a claim being made.

Find out more about Property Insurance here